Pag-unawa sa Mga Pangunahing Pagkakaiba sa Pagitan ng Flexible at Regular na LED Display

Mga Pangunahing Pagkakaiba sa Pagitan ng Flexible na LED Display at Regular na LED Display Screen

Ang bagong alon ng mga flexible LED display ay gumagamit ng magaan, mapapalit na materyales tulad ng polyimide substrates na nagpapahintulot sa kanila na kumurba nang buo hanggang 180 degrees. Ito ay nagbubukas ng mga posibilidad para sa pag-install ng mga display na ito sa mga bagay tulad ng mga arko, haligi, o anumang iba't ibang hugis na ibabaw na karaniwang hindi posible sa mga karaniwang screen. Ang tradisyonal na LED setups ay nakakabit sa mga mabibigat na frame na gawa sa aluminum o plastic na hindi talaga mababago ang hugis, kaya ang tanging magandang tingnan ay kapag naka-mount nang patag. Isang ulat mula sa industriya noong 2025 ay nagsasaad ng isang kakaibang bagay. Ang flexible na bersyon ay mayroong karaniwang 5,000 hanggang 8,000 nits na ningning, na sapat para sa paggamit sa loob ng gusali kung saan hindi gaanong matindi ang glare. Ngunit ang mga luma nang rigid panel? Karaniwan silang umaabot sa higit sa 10,000 nits, na nangangahulugan na mas nakikita sila sa labas sa ilalim ng maliwanag na araw.

| Tampok | Flexible LED Display (Ang mga LED na Display na Flexible) | Karaniwang LED Display |

|---|---|---|

| Saklaw ng Hugis | Mga kurba, silindro, sphere | Mga patag na ibabaw lamang |

| Kumplikadong Pag-install | Mababa (modular na disenyo) | Matataas (istraktura ng frame) |

| Gastos bawat m² (2025) | $4,000–$8,000 | $1,500–$3,500 |

Mga Saklaw ng Presyo Bawat Metro Kuwadrado para sa Flexible at Flat na LED Display sa 2025

Ang flexible na LED display ay karaniwang mas mahal dahil sa mga kailangang espesyal na materyales at komplikadong proseso ng paggawa. Isa sa mga pangunahing dahilan ay ang proseso ng encapsulation na kinakailangan para mapanatiling tuyo ang mga sensitibong bahagi nito, na nagdaragdag ng humigit-kumulang 25 hanggang 40 porsiyento sa kabuuang gastos ng produksyon. Ayon sa mga uso sa merkado, ang mga karaniwang rigid panel ay nagiging mas murahin taon-taon ng mga 12 porsiyento dahil sa mga benepisyo ng mass production. Ngunit sa flexible display, ang pagbaba ng presyo ay mas mabagal, na bumababa lamang ng 6 hanggang 8 porsiyento bawat taon. Ang pagkakaibang ito ay makatwiran kung isisigaw ang mga espesyal na teknik sa paggawa na kinakailangan para sa flexible na teknolohiya, kasama na ang katotohanan na ang mga tagagawa ay hindi pa nagpoproduce ng flexible display sa parehong dami ng sa tradisyonal na display.

Pangkalahatang-ideya ng Kasalukuyang Tendensya sa Presyo ng Merkado para sa Gastos ng LED Display

Ayon sa pinakabagong Ulat sa Merkado ng Digital Signage para sa 2024, nakikita tayo ng humigit-kumulang 17% taunang paglago sa paraan ng pagtanggap ng mga negosyo sa teknolohiyang flexible LED para sa mga bagay tulad ng mga tindahan at kaganapan. Gusto ng mga tao ang mga kahanga-hangang visual na karanasan kahit na ang mga ganitong setup ay may mataas na presyo. Pagdating sa mga ultra high definition screen na may pixel pitch na nasa 1.2mm o mas mababa, tumaas nang malaki ang gastos. Ang isang square meter ng 4K flexible display ay karaniwang nasa pagitan ng humigit-kumulang $6,200 hanggang halos $10,000. Kakaibang kontrast dito ay ang tradisyonal na rigid LED panels na hawak pa rin ang humigit-kumulang 72% ng kabuuang merkado. Karaniwang makikita ang mga ito sa labas sa mga billboard at sa mga sports arena kung saan hindi gaanong mahalaga kung gaano kabaluktot ang screen, kundi kung ito ay matatagalan ang kondisyon ng panahon at makakapagliwanag nang sapat para mahatak ang atensyon ng lahat.

Mga Pangunahing Salik na Nagtutulak sa Presyo ng LED Display

Epekto ng Pixel Pitch at Resolution sa Presyo ng LED Display

Ang spacing sa pagitan ng mga LED, na kilala bilang pixel pitch at sinusukat sa millimeter, ay gumaganap ng malaking papel kung gaano kaliwanag ang imahe at anong distansya ang pinakamainam para manood. Kapag nagsasalita tayo ng mas maliit na pitch tulad ng P1.2, ang mga screen na ito ay gumagawa ng mas malinaw na imahe, bagaman may mas mataas na presyo na umaabot sa 25 hanggang 40 porsiyento kumpara sa mga mas malaking pitch tulad ng P4 hanggang P10. Ang pagtaas ng gastos na ito ay dulot ng pangangailangan ng mas maraming LED na nakapako nang masikip at mahigpit na pamantayan sa produksyon. Kung titignan ang mga tunay na numero, maaaring asahan ng isang tao na magkakahalaga ng humigit-kumulang $2,800 bawat square meter ang isang display na P1.5 kumpara naman sa halos kalahati nito, na umaabot sa $1,200 bawat square meter para sa isang karaniwang P10 setup ayon sa mga pinakabagong uso sa merkado. At lalong tataas ang presyo kapag isinasaalang-alang ang mga high res display dahil kailangan ng mas mataas na kalidad na driver chips at pinabuting sistema ng paglamig na karaniwang nagdaragdag ng 15 hanggang 20 porsiyento sa base price na nasa mataas na presyo na.

Mga Rekwisito sa Kaliwanagan at mga Pag-iisip sa Paggamit sa Loob at Labas ng Bahay

Ang mga LED display sa labas ay dapat makamit ang kaliwanagan na 5,000–10,000 nits at mayroong IP65-rated na proteksyon sa panahon, na nagdaragdag ng 30–50% sa gastos ng produksyon kumpara sa mga modelo na para sa loob ng bahay (2,000–3,000 nits). Ang mga matibay na yunit na ito ay mayroong mga pinatibay na cabinet, UV-resistant na mga patong, at mga active cooling system, na nagreresulta sa mga premium na pag-install na may presyo na $3,200–$4,500/m² (Reiss Display 2025).

Sukat ng Display at ang Epekto Nito sa Kabuuang Gastos ng LED Display

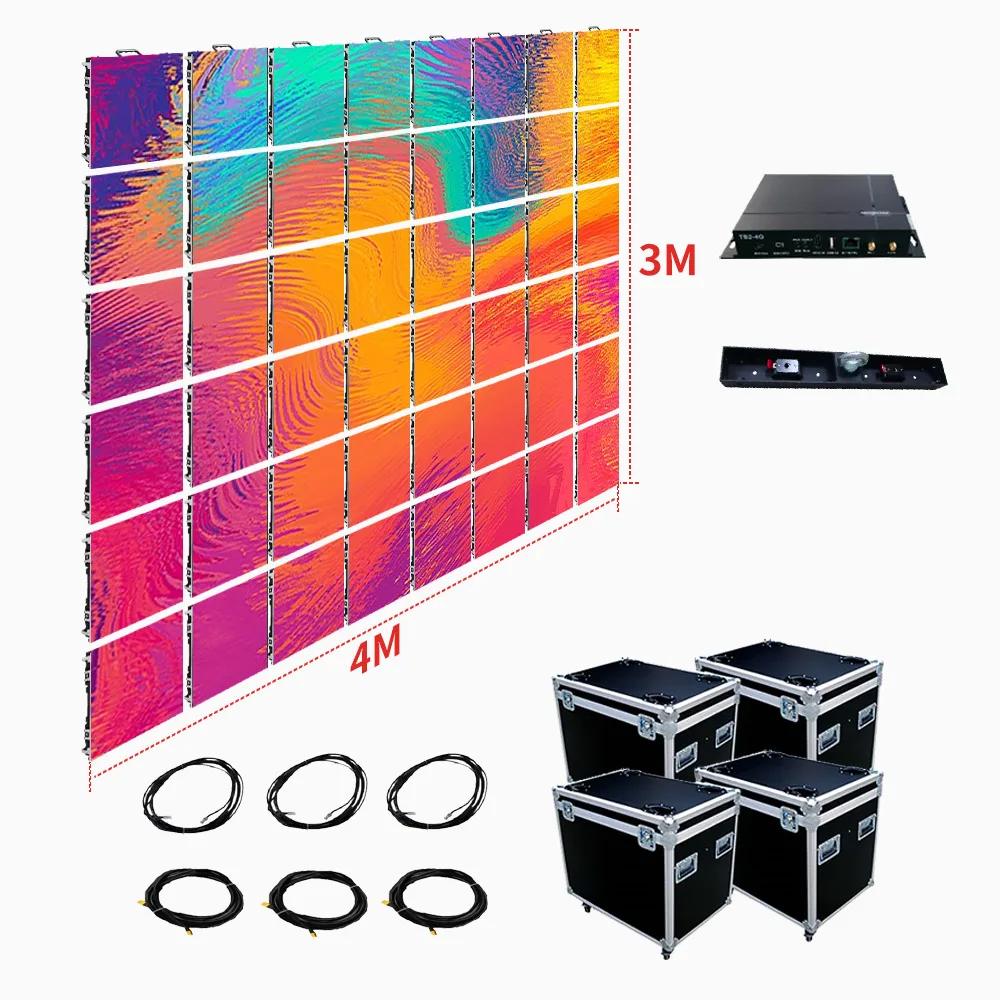

Pagdating sa mas malalaking instolasyon, mayroong talagang pag-iiimpok sa gastos kapag bumibili nang maramihan. Ang presyo bawat metro kuwadrado ay karaniwang bumababa nang humigit-kumulang 8 hanggang 15 porsiyento kapag ang isang tao ay nag-uutos ng higit sa 50 metro kuwadrado na materyales. Sa kabilang banda, ang mga maliit na custom na trabaho na nasa ilalim ng 10 metro kuwadrado ay karaniwang nagkakahalaga nang mas mataas. Tinataya ito na humigit-kumulang 20 porsiyentong ekstra at minsan ay umaabot pa sa 35 porsiyento dahil kailangan ito ng espesyal na pagputol, iba't ibang uri ng suporta para sa pag-mount, at higit pang tao sa lugar ng pag-install. Sa buti, ang mga modular na sistema ay nagsimula ng paggawa ng mga bagay na mas madali para sa mga proyekto na katamtaman ang laki. Sa mga susunod na taon, maraming tao ang nakikita ang presyo na nasa pagitan ng $1800 at $2200 bawat metro kuwadrado para sa karaniwang mga setup na sumasaklaw ng humigit-kumulang anim na metro kuwadrado ng kabuuang espasyo.

Mga Pangangailangan sa Pagpapasadya at Komplikadong Istruktura sa Mga Flexible na LED Display

Ang mga curved o natatanging hugis na installation ay nangangailangan ng flexible na PCB substrates at tumpak na frame-by-frame calibration, na nagdudulot ng pagtaas ng labor cost ng 40–60%. Ayon sa market analysis noong 2024, ang average na gastos para sa curved setup ay $3,800/m² kumpara sa $2,500/m² para sa flat setup. Ang karagdagang structural support para sa cantilevered o rotating displays ay maaaring magdagdag ng $300–$700/m² sa kabuuang gastos ng proyekto.

Kabuuang Gastos ng Pagmamay-ari: Lampas sa Paunang Presyo ng LED Display

Mga hamon sa pag-install at labor cost para sa flexible LED screens

Ang flexible LED displays ay nangangailangan ng mga espesyalisadong grupo sa pag-install na may pagsasanay sa paghawak ng delikadong bendable modules at sensitibong interconnects. Madalas ay kailangan ang custom mounting systems upang mapanatili ang integridad ng curvature, na nagdudulot ng pagtaas ng labor cost ng 15–25% kumpara sa mga karaniwang flat-panel installation.

Pagpapadala, paghawak, at structural support para sa mga large-format LED displays

Ang paghahatid ng LED panels na may sukat na higit sa 10m² ay nangangailangan ng climate-controlled containers at shock-absorbent packaging, na nagpapataas ng gastos sa logistiksa halagang $8 hanggang $12 bawat square meter. Dapat suriin ng structural engineers ang load capacity ng gusali bago isagawa ang installation, kung saan ang kinakailangang reinforcements ay nagdaragdag ng $2,500 hanggang $7,000 sa badyet ng proyekto.

Mga pagkakaiba sa pangmatagalang gastos sa pagpapanatili at pagkumpuni

Ang mga flexible LED models ay nangangailangan ng 40% higit pang madalas na serbisyo kumpara sa rigid displays dahil sa epekto ng stress sa connectors sa curved configurations. Ang maintenance contracts para sa high-resolution displays (¤1.5mm pixel pitch) ay may average na 18% mas mataas bawat taon kumpara sa mga standard-pitch models, na nagpapakita ng kumplikado ng component access at alignment.

Kahusayan sa paggamit ng kuryente at pangmatagalang pagtitipid sa operasyon

Ang modernong LED display ay nagpapababa ng konsumo ng kuryente ng 30–40% sa pamamagitan ng matalinong kontrol sa ningning at modular na arkitektura ng kuryente. Ang isang display na 50m² na gumagana ng 12 oras araw-araw ay makakatipid ng $1,200–$1,800 bawat taon sa gastos sa kuryente kumpara sa mga lumang modelo, kung saan ang buong return on investment ay karaniwang nakakamit sa loob ng 3–5 taon.

Mga Saklaw ng Presyo ng LED Display Ayon sa Sukat at Gamit

Pagsusuri sa Gastos para sa Maliit na Sukat na Flexible at Regular na LED Display

Ang maliit na LED display (1–5 m²) ay nag-iiba nang malaki ayon sa uri at aplikasyon. Ang mga standard na panlabas na panel para sa retail o mga silid ng kumperensya ay nasa saklaw na $1,500–$6,000, samantalang ang mga flexible na bersyon ay nagsisimula sa $5,000+dahil sa mga espesyalisadong materyales at kinakailangan sa curved mounting.

| Uri ng Display | Karaniwang Sukat | Saklaw ng Presyo (2025) | Mga Karaniwang Gamit |

|---|---|---|---|

| Nakapirming Panloob | 2m x 1m | $3,000–$6,000 | Mga kiosko sa tingi, tanggapan |

| Lumalaban sa Panlabas | 3m x 1.5m | $8,000–$15,000 | Baluktot na signage, pop-up na mga kaganapan |

Presyo ng Mid-Range na Display: Pagbalanse ng Performance at Budget

Ang mga mid-sized na display (5–20 m²) ay karaniwang binibigyan-priyoridad ang resolusyon kaysa sa kakayahang umangkop, lalo na para sa mga backdrop ng kaganapan at advertising. Ang mga pixel pitch sa pagitan ng P2.5 at P4 ang nangingibabaw sa segment na ito, kung saan ang mga standard model ay nagkakahalaga ng $3,500–$7,000/m² at ang mga flexible variant ay nagkakahalaga ng 25–40% na mas mataas.

Mga Istruktura ng Gastos ng Large-Format na LED Display at Mga Ekonomiya sa Sukat

Para sa mga proyekto na higit sa 20 m², ang bulk pricing ay binabawasan ang mga gastos sa $2,800–$4,200/m² para sa mga standard na installation. Bagama't ang mga flexible na display na may malaking sukat ay may 30% pang-premyo pa rin, ang kanilang maaaring gamitin muli sa mga touring productions at events ay nagpapabuti ng long-term ROI.

Mga Aplikasyon sa Industriya: Event Staging, Retail, at Architectural Integration

- Pagtatayo ng event : Ang average ng mga upa ng flexible screen $5,000–$10,000/araw para sa 50m² na setup

- Mga tindahan : Ang mga custom na curved display (P3 pitch) ay nagkakahalaga ng $12,000–$25,000para sa 10m² na interactive storefronts

- Arkitektura : Ang seamless LED facades ay nangangailangan ng $200–$500/m² sa structural support, na epektibong nagdo-doble sa kabuuang gastos ng proyekto kumpara sa flat installations

FAQ

Ano ang mga pangunahing pagkakaiba sa pagitan ng flexible at regular na LED displays?

Ang flexible LED displays ay maaaring umukop at umangkop sa iba't ibang hugis tulad ng cylinders at spheres, na nagpapagawaing perpekto para sa hindi patag na surface, samantalang ang regular na LED displays ay limitado lamang sa patag na surface.

Bakit mas mahal ang flexible LED displays?

Ginagamit nila ang specialized materials at kumplikadong proseso ng paggawa, kabilang ang encapsulation upang maiwasan ang kahalumigmigan, na nagdaragdag ng 25-40% sa gastos ng produksyon.

Paano nakakaapekto ang pixel pitch sa presyo ng LED display?

Ang mas maliit na pixel pitch, tulad ng P1.2, ay nagbibigay ng mas malinaw na imahe ngunit may mas mataas na presyo kumpara sa mas malaking pitch tulad ng P10, dahil sa mas maraming LED na ginagamit at mas mahigpit na pamantayan sa paggawa.

Anu-ano ang mga salik na nakakaapekto sa kabuuang gastos ng pagmamay-ari ng LED displays?

Mga salik ay kinabibilangan ng kahirapan ng pag-install, pagpapadala at paghawak, pangangailangan sa pagpapanatili, at pagkonsumo ng enerhiya. Ang mga flexible display ay may mas mataas na gastos sa paggawa at pagpapareserba.